Key Takeaways

Most financial advisors I know struggle with repetitive, time-consuming tasks:

- Replying to emails can take up to 8 hours per week.

- Marketing efforts – like writing LinkedIn posts, client newsletters and blog articles – can also take hours.

- Back-office admin is slow, manual and cumbersome (e.g. managing your CRM).

Yet, what if you could automate a lot of this – freeing up your time to do what you are good at, and actually want to do (advising clients)?

There is great news. In 2025, technology has opened up some immense opportunities in marketing automation for financial advisors.

Here’s a recent example from one of my projects:

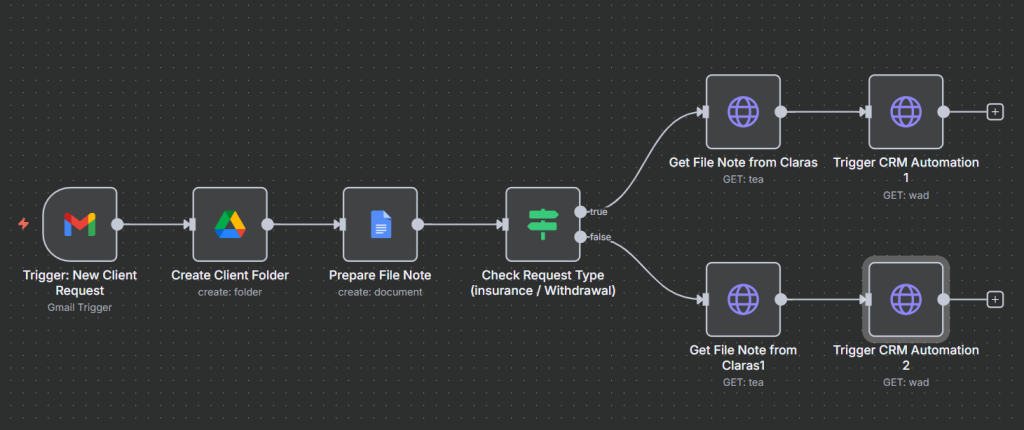

- An Australian financial advisor was getting bogged down with his client management system. So, he asked if I could automate one process that was really bothering him.

- Here was the issue: his assistant was constantly dealing with client requests to withdraw money or cancel/reduce insurances. It added up to hours of her time every week.

- After he wrote the process down, I created an automation for this financial advisor (using n8n) that does ~80% of the work using a triggered workflow.

- The automation saves ~2 hours of the assistant’s time per week, and ~1 hour for the financial advisor (translating into $10,000+ in value).

Here is a snapshot showing one part of the n8n workflow:

This is just touching the surface of the possibilities. Marketing automation for financial advisors is an exciting new frontier.

However, most other articles I’ve seen do not cover this topic properly or miss the point (e.g. merely acting as affiliates for all-in-one marketing platforms).

In this guide, I’m going to give you real, “on-the-ground” insights from my own work in financial advisor automation.

Rather than just point you to generic, subscription-based tools like Hubspot, I’ll show you a more customised, robust approach to automating your marketing as a financial advisor.

Here’s are some quick takeaways from what lies ahead:

- Financial advisors often lose 10–20 hours per week to repetitive admin, email, and marketing tasks.

- Marketing automation can free up this time – letting advisors focus on clients and revenue growth.

- Real-world examples show advisors saving $10,000+ in value each year by automating processes with tools like n8n.

- Front-end automations help with lead generation, sales systems and conversion optimisation (e.g. faster response times, lead scoring, nurture sequences).

- Back-end automations streamline admin, compliance, recruitment, and scheduling – removing bottlenecks that slow client service.

- Done right, automation can handle 80%+ of the legwork in marketing and back-end operations.

- Unlike “one-size-fits-all” SaaS platforms, custom-built automations give advisors lower costs, full ownership and flexibility to adapt as their business evolves.

Put these strategies to work and you’ll not only run a smarter, more efficient practice – you’ll deliver the kind of client experience that’s impossible to ignore.

Marketing Automation For Financial Advisors: An Overview

Most financial advisors are highly “manual” in their marketing:

- Hand-crafting email outreach to other companies (e.g. mortgage brokers / lawyers / accountants).

- Agonising over the topics (and crafting) of LinkedIn posts and article drafts.

- Pain-stakingly trying to organise their email lists and join everything up with other apps in their tech stack.

However, what if you could automate 80% (or more) of the legwork?

For instance:

- Preparing email templates/drafts using recipient data from your CRM and the open source (e.g. LinkedIn profile information).

- Scheduling regular topic ideas based on Google Trends, popular industry topics etc – and sending you pre-written “skeleton drafts” based on your pre-defined brand guidelines?

- Routing (and re-routing) a prospect’s data based on triggers and their behaviour, syncing it all up across your various apps?

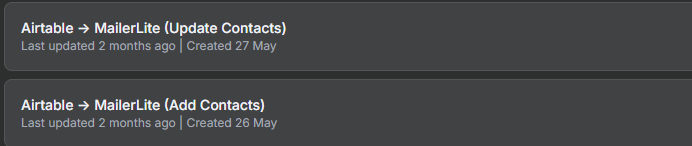

To illustrate that last point, here’s an example of two marketing automations for financial advisors:

Here, the financial advisor marketing automation is performing multiple tasks behind the scenes:

- A new potential client arrives into the advisor’s CRM (Airtable) – e.g. after some successful outreach by the advisor via LinkedIn.

- The system then adds the prospects to the advisor’s email marketing provider (MailerLite) – including key data such as their main pain point (e.g. tax planning), location and interests.

- Any future updates the advisor makes to the prospect in Airtable is also automatically carried over to MailerLite (providing complete data synchronisation).

Depending on the advisor’s lead flow, this process could save 1-2 hours per week.

(These screenshots I’ve used are from n8n – a workflow automation platform that allows financial advisors to build their own business process automations.

I specialise in helping advisors craft these automations as one-off projects, so they own the infrastructure and can customise it later as their business changes).

Types of Financial Advisor Marketing Automation

Broadly speaking, automation for financial advisors can be divided into two categories:

- Front-end: Includes systems for lead generation (e.g. speed to lead), sales systems (like the example I showed above) and conversion optimisation systems (e.g. lead scoring).

- Back-end: Includes systems for document processing (like the client management system I mentioned at the beginning), recruitment screening (e.g. job application filtering on your website) and employee scheduling (e.g. to manage offshore paraplanning services).

Marketing automation for financial advisors largely falls into the Front-End category, but I wanted to show you that there are possibilities even beyond that frontier.

Here is a closer look at these two types of automation for financial advisors:

Front-End Systems

These automations focus on attracting and converting new clients – e.g. boosting visibility and engagement, perhaps using blogs, videos and social media posts.

Lead Generation Automation

Here’s an example of a lead generation system for financial advisor marketing automation:

- An Australian advisor spoke to me on LinkedIn about improving their “speed to lead” (i.e. responding to a prospect’s email/message inquiry faster).

- A 1-minute response time, for instance, can improve conversion rates by over 300%. So, closing the time gap could have a massive impact on the advisor’s business growth.

- Using n8n, the advisor gained some powerful workflows to drive down his response time, from days to minutes – combining Active Campaign, forms and in-house reporting tools.

Automated Sales Systems

Here, the focus is to improve lead qualification and nurturing – i.e. narrow down on your ideal target client, and do a better job of building trust (so they are more likely to pick you over a competitor).

A good example of this is automated asset generation. For instance, if you need a PDF guide on estate planning to offer a potential client, you build a workflow to produce a template which gets you 80% of the way there in minutes.

You can then personalise, customise and run final compliance checks before sending it over.

Conversion Optimisation Systems

This type of marketing automation for financial advisors takes two main forms:

- Personalised follow-up and nurture. Financial advisors typically have long sales cycles (e.g. weeks or months). If you are doing manual check-ins, it’s easy for leads to get dropped. Here, marketing automation can do a lot of the heavy lifting – e.g. email nurture sequences tailored to specific segments in your wider list.

- Automatic lead scoring. If an inquiry comes in, a workflow can run a series of pre-defined checks (using an AI model) to judge how closely the person matches your ideal client persona (ICP). A high match gets a higher score (e.g. 8/9 out of 10); a low match gets a low score.

Back-End Systems

I’ve also worked with automated marketing for financial advisors “behind the scenes”. Here, the aim is to improve the infrastructure that supports the firm’s overall marketing efforts (e.g. updating, sorting and cleaning of contact databases).

Document Processing Automations

A recent Barron’s survey showed that financial advisors spend 20-40% of their time on administrative and back-office tasks.

This takes away from your client-facing time (and, let’s be honest, it’s often very boring work!).

The good news? Financial advisor marketing automation has come a long way in 2025. It is now possible to outsource a lot of this work to customised systems – using tools like n8n:

- Onboarding and data collection (e.g. chasing KYC info and pension scheme documents).

- Facilitating client data analysis and due diligence (e.g. to help with document preparation, such as a Statement of Advice).

- Compliance management (e.g. setting up a dedicated workflow to highlight potential issues with regulators during the process of creating an article or client-facing document).

Recruitment Screening

The world of job-hunting has become even more chaotic in 2025, with more candidates relying on artificial intelligence (AI) to write and submit applications for jobs (many of which they are not qualified for!).

Due to this spam risk when posting vacancies, many financial advisors now have little choice but to fight fire with fire – setting up automations which help filter out the application “dross”.

A recruitment screening workflow can also free up a lot of your time. Rather than manually reading through 100+ applications for an assistant role, the system can be trained to look out for the key traits (and “red flags”) you are looking for – narrowing down your list of viable candidates to just a handful.

Employee Scheduling

A financial advisor’s business will have fluctuating needs and demands – often getting more intense during key dates, such as near the end of the financial year.

Sudden events can also cause a scramble, putting pressure on teams. For instance, a market crash could cause an influx of client emails, asking for guidance and reassurance.

Automation can greatly enhance an advisory firm’s ability to cope under these rapid changes in conditions – e.g. using algorithmic scheduling and real-time communication with off-shore teams (e.g. paraplanning services).

Hand-Crafted Marketing Automation for Financial Advisors

I mentioned earlier that many articles written on marketing automation are pushing products that only “fix” one piece of the puzzle for financial advisors.

For instance, when doing research for this article, I found two others simply recommending tools like Hubspot to manage email marketing, landing pages etc.

The problem? Firstly, the cost is ill-fitted to most advisors. Hubspot’s Content Hub Professional Plan can cost up to $1,500 per month.

Secondly, how do you then address other areas of your advisory practice that you might want to automate? Potentially, that means forking out for another tool – which may not “play nice” with the others you’ve got.

This is why I take a different approach to financial advisor marketing automation. Rather than “rent out” automations from another business (which might not fit yours neatly), I help financial advisors build their own customised infrastructure for AI and automations.

The benefits include:

- Lower costs (a one-off project rather than an ongoing subscription to a SaaS company).

- Ownership (the infrastructure is yours after project handover).

- Flexibility (update and change your automations as your business evolves and grows).

Want to Find Out More?

If you’re curious to learn more about my project-based approach to financial advisor automation, please get in touch using the form below.

I’d love to send you the pricing and a more detailed breakdown.

Philip Teale is a MCIM marketer with over 10 years’ experience working with financial advisors – helping them gain new revenue and clients using online channels and AI-powered workflows.