Key Takeaways

Many advisors are drowning in admin. Fortunately, in 2025, technology is finally throwing a lifeline: powerful, intelligent AI tools for financial advisors.

Rather than manually chasing every lead, dealing with compliance or onboarding new clients, the best AI tools for financial advisors are doing the heavy lifting in the background – allowing you to focus on what you enjoy and do best (advising!).

Being an “AI Financial Advisor” is not about replacing you or your team.

Rather, the aim is to enhance your ability to find the best target-fit clients, serve them better, improve your margins and accelerate growth.

You also don’t need to be a large firm to become an AI-powered financial advisor.

Using low-code tools like n8n and self-hosting, even solo advisors can massively improve their marketing funnel and internal ops.

Below, I’ll be sharing 5 use cases of AI tools for financial advisors, the potential impact on your bottom line and how to get started.

Here are the key takeaways that lie ahead regarding financial advisor AI:

- Advisors often get their hands tied by compliance when trying to publish an article or newsletter. With financial advisor AI, you can automate much of the review process, get better feedback and publish faster.

- Leads get dropped by advisors, and the high-quality ones get overlooked in a sea of other enquiries. With financial advisor AI, you can develop systems that automate your process for qualifying leads – also enriching them with more data.

- How do you find the time to post on LinkedIn and elsewhere? With n8n, you can set up a workflow that takes content you’ve already written and “repackages” it into bite-sized posts ready for social media.

- The process of onboarding them can be slow and arduous. An AI-powered financial advisor can automate many of the steps involved (e.g. sending out KYC requests and reminders) so you can improve your speed-to-revenue.

- Client retention is vital for building a profitable advisory firm. Yet, many clients complain about advisor neglect once they’re on the books. With AI, you can automate some valuable brand touchpoints and follow-up for existing clients, such as “life event monitoring”.

Financial Advisor AI Tools Summary

| Financial Advisor AI Tool | Use Cases | Potential Impact |

| Compliance Monitor | Content review, audit trails, notifications and reporting. | Lower compliance risk, faster publication times, higher-quality content, strong paper trail (accountability) |

| Lead Qualifier & Enricher | Normalise lead intake, de-dupe and validate enquiries, qualify intent, enrich the data & score the lead before passing to the CRM. | Most/all leads accounted for and prioritised, faster speed-to-lead (higher conversion rates), better marketing ROI, less manual research. |

| Client Onboarder | A “compliance-friendly welcome engine”, KYC data collection, doc management, fact-find automation, advisor–client communication sync. | Shorter time-to-active client (faster speed to revenue), higher completion rates, reduced admin time, better client experience, scalability. |

| SEO & Content Optimiser | Blog post competitor gap analysis, automate checks for keyword coverage & on-page SEO audits, internal linking suggestions, AI-assisted social media drafts. | Higher visibility in Google search and AI results, stronger topical authority, reduced content decay, more consistent & targeted social media publishing. |

| Client Retention System | Life event monitoring (e.g. anniversaries), review meeting scheduling, service satisfaction monitoring, alerts for “at risk” clients, cross/upsell opportunity highlights. | Improved client retention, better lifetime value (LTV), more referrals, stronger client experience, more cross/upsell revenue, reduced admin/adviser time. |

Ready to see what’s possible with financial advisor AI tools?

Dive into the full article for five actionable ways to make AI your new secret weapon, without losing your signature human touch.

Use #1: Compliance Monitor

Lowering Regulatory Risk

As many as 80% of financial advisors regard compliance as one of their “Top Three” challenges, with 50% citing it as their biggest issue.

Navigating the complex and changing rules of your industry takes up a lot of time and money. Doing it all manually is slow and error-prone. However, technology is changing the game here.

Financial advisor AI can remove a lot of the headache with checking for compliance. Here is a specific use case I am working on right now with advisors:

- An advisor drafts an article for the firm’s website and puts it in a “holding area”.

- The n8n system picks it up and a pre-trained AI agent scans it for potential regulatory issues.

- Suggested improvements are inserted into the Word Doc.

- Human compliance is notified. They can approve and/or leave comments.

- The advisor makes final changes, everyone reviews and the article is published.

The result? A much faster, more accountable content creation system that adds an extra layer of protection against regulatory risk.

Use #2: Lead Qualifier & Enricher

Are you getting leads, but they’re falling through the cracks?

In my years working with advisors as a marketer, this is all too common when enquiries are coming in from multiple sources – e.g. website forms, email and LinkedIn direct messages (DMs).

Another issue is that advisors are busy and don’t have time to follow up on every lead. Without a filtering system, valuable potential clients can slip through the cracks.

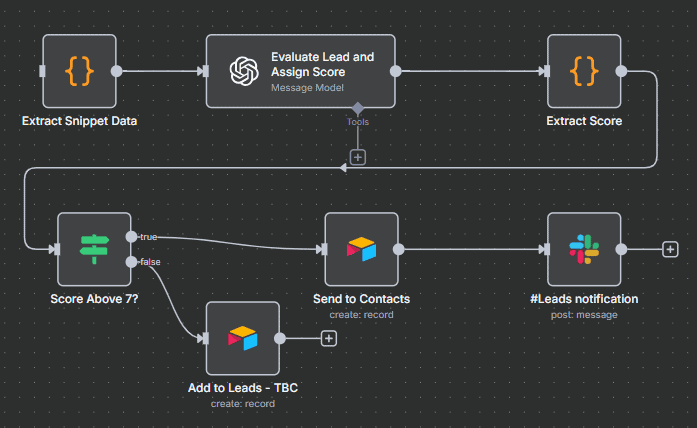

This is where financial advisor AI can really shine. Using a low-code tool like n8n, you can build a Lead Qualification & Enrichment workflow that:

- Regularly checks different intake locations for emails from potential new leads (e.g. inboxes).

- Screens them against your existing contacts (team members and existing clients).

- Runs an initial “firm fit” analysis (region, service type, net worth indicators etc.).

- Proceeds to enrich the lead if it looks promising, using open source information (e.g. LinkedIn profile and company info).

- Uses AI tools to score the lead and route to your CRM, sending out a notification to the advisor if it looks urgent or promising.

The result of this financial advisor AI tool? Faster, smarter follow-up with potential leads. Higher conversion rates. Laser-focus on the leads that hold out greater lifetime value (LTV).

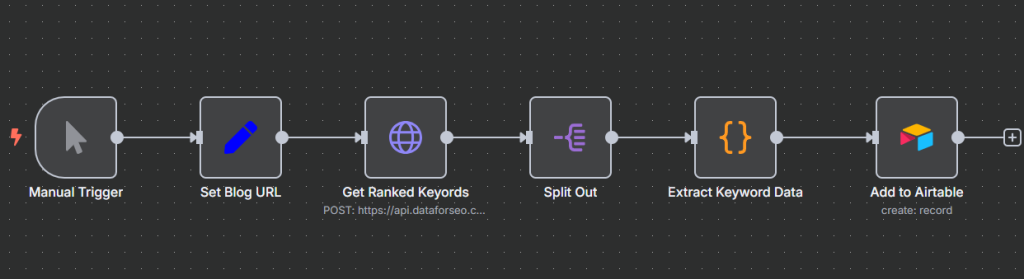

Here is a snapshot of an n8n workflow I recently built for an advisor:

Use #3: Client Onboarder

Speed to Revenue

You’ve just won a new client, but now it’s time to officially bring them onboard.

That means asking them for KYC information, pension documents and other sensitive personal info which is crucial to your service delivery as an advisor.

It can be a pain gathering all of these files and data, especially for wealthy clients with complex estates. Indeed, it can take up to 3 months for some firms to onboard an ultra-high net worth client.

Ultimately, the growth of an advisory firm boils down to two things:

- Finding ideal clients (lead gen).

- Onboarding speed.

With n8n, you can build financial advisor AI tools that accelerate the latter.

A Real Example

Here is a snapshot of a workflow I recently submitted to an advisor in Australia along these lines:

Here, the system is automating the majority of the requests and follow up to clients.

If the client starts dragging their heels at a particular point in the onboarding process (e.g. providing KYC info), an automated SMS or email can be drafted (or sent) on behalf of the advisor.

If things get really stuck, a notification and summary of the issues can also be sent to the advisor, with recommendations to push the client forwards.

This is just scratching the surface with financial advisor AI and client onboarding. Here are some other use cases for automation in this area:

- Smart outreach to pension providers (e.g. conflicting/missing info).

- Detection of policy conflicts or inconsistencies

- Suitability report generation, accounting for different products, client info etc.

- Vulnerability detection – e.g. from meeting recordings with new clients.

Use #4: SEO & Content Optimiser

SEO Enhancement

As a marketer, part of the job is learning how to use tools like Ahrefs, SEMrush and SurferSEO to help advisors with their content creation efforts.

These tools are powerful. For instance, they give you a much clearer idea of where to focus their SEO (e.g. realistic target keywords to rank for). However, they are costly and have a high learning curve.

Amazingly, AI is lowering the barriers for advisors.

Here is an example of a system I recently built using n8n, which helps advisors analyse a competitor’s high-ranking blog post and identify the keywords it ranks for in Google search:

From there, the advisor can craft their own post targeting the same keywords – giving them a better chance of appearing high in Google Search results.

All of this without an expensive SEMrush or Ahrefs subscription!

Content Optimisation

How might you improve a blog post you’ve already written, empowering it to rank higher in Google and convert more website visitors into enquiries?

For years, marketers relied on third-party research (e.g. the Moz blog) to try and guess what search engines want to see in a blog post. Now, with these same search engines using AI, you can go straight to the source!

For instance, I recently built an n8n workflow that talks directly to Gemini (Google’s primary AI model) about an advisor’s blog post, compares it to the top 10 search results for its target keywords, and then provides an actionable report to improve it!

Social Media Empowerment

All too often, advisors feel stuck about what to post on social media. You want to push out a valuable weekly LinkedIn post, but what on earth do you write about?

Again, financial advisor AI tools can remove a lot of the headache.

A case in point: I recently made an n8n workflow that takes an article written by an advisor, extracts the key messages and repackages them into bite-sized posts, ready for social media.

The advisor can then amend the drafts and schedule them as weekly posts over the next month!

Use #5: Client Retention System

Life Event Monitoring

It’s very common for advisor clients to feel neglected.

Indeed, one study showed that 47% of clients with over $500,000 under advisory would like to hear from their advisor more frequently – citing monthly as their preference.

One great way to show that you care about your clients is to reach out to them in a meaningful way when they reach an important life milestone.

In the good old days, this took the form of sending a handwritten birthday card. Today, financial advisor AI tools allow you to automate much of this outreach – without losing the personal touch.

A recent example: I recently designed a Life Event Monitor for an advisor using n8n.

I checks an Airtable record for key dates in the client’s calendar (anniversary, birthday etc.), sends a reminder via Slack to the advisor as the day approaches, and prepares a draft email or message that the advisor can tailor before send-out.

Think of it as automated thoughtfulness. It makes a huge difference to client loyalty and retention.

Of course, you can also do a similar thing with periodic review invitations.

How To Start With Financial Advisor AI Tools

Two Options

These five use cases are just the tip of the iceberg when it comes to financial advisor AI tools.

There are many other potential applications, and lots of room for innovation (which is exciting for me as an automator in this sector!).

How do you get started as an AI-powered financial advisor? Broadly, there are two main approaches.

The first is to turn to “done-for-you” models which offer a subscription service. For instance, you could find a fintech offering a type of Client Retention System and rent it out for a monthly fee.

In my view, there are lots of problems with this. In particular, advisors are overpaying for many of these tools – which they don’t truly own, and which often don’t talk nicely to each other.

The second route is to build your own financial advisor AI infrastructure, using n8n and other tools (e.g. Airtable). This is more of a “project-based” route, which gives you more ownership over your automations, data and costs.

Want to Find Out More?

If you’re curious to learn more about my project-based approach to financial advisor AI tools, please get in touch using the form below.

I’d love to send you the pricing and a more detailed breakdown.

Philip Teale is a MCIM marketer with over 10 years’ experience working with financial advisors – helping them gain new revenue and clients using online channels and AI-powered workflows.